Every business decision involves some level of prediction. Whether you're planning next quarter's marketing budget or trying to anticipate customer demand, you're essentially looking at past patterns to guess what might happen next. Predictive timeline analysis takes this natural human tendency and transforms it into a systematic, data-driven process.

Unlike traditional forecasting methods that often rely on isolated data points, timeline-based predictions use the sequential nature of events to build more accurate models. This approach recognizes that events don't happen in isolation, they follow patterns, create chains of consequences, and often repeat with predictable timing, insights that become clearer when viewed on a timeline.

This article shows you how to harness these patterns to make better predictions for your business, from understanding the basics to building your first working model.

What makes timeline-based forecasting different

Traditional forecasting methods often treat data points as independent variables. You might look at last month's sales figures, factor in seasonal trends, and make educated guesses about next month. Timeline-based forecasting takes a fundamentally different approach by treating time as a primary organizing principle.

When you forecast based on time series data, you're acknowledging that the sequence of events matters as much as the events themselves. A sales spike in January followed by a February dip tells a different story than the same figures appearing in reverse order. This sequential context becomes the foundation for more nuanced predictions.

Time series-based forecasting excels in situations where patterns emerge over extended periods. Consider how retail businesses track customer behavior throughout the year. The data reveals not just seasonal peaks and valleys, but also the subtle shifts that precede major changes. A gradual decline in repeat purchases might signal customer satisfaction issues months before they show up in obvious metrics.

The mathematical models behind this approach assume that past patterns contain information about future possibilities. This assumption isn't always correct, but it proves remarkably reliable in stable environments where underlying systems remain consistent.

Core components of predictive timeline analysis

Timeline prediction relies on several key pieces fitting together properly. Getting these fundamentals right means your forecasts will be more accurate and you'll avoid the mistakes that derail most prediction projects.

Data quality and consistency

Your predictions are only as good as your source data. Timeline analysis requires consistent measurement intervals, complete records, and accurate timestamps. Missing data points create gaps that can throw off pattern recognition, while inconsistent measurement methods introduce noise that obscures real trends.

Pattern identification algorithms

Modern forecasting techniques that are based on time series data assume certain mathematical relationships exist within your dataset. Autoregressive models look for correlations between current values and previous ones. Moving average calculations smooth out short-term fluctuations to reveal longer-term trends. Seasonal decomposition separates recurring patterns from underlying growth or decline.

Model selection criteria

Different timeline patterns require different analytical approaches. Linear trends work well with simple regression models, while cyclical patterns might need more sophisticated techniques like ARIMA (Autoregressive Integrated Moving Average) or exponential smoothing. The choice depends on your data characteristics and prediction requirements.

Validation and testing frameworks

Any prediction model needs rigorous testing before you can trust its output. Cross-validation techniques split your historical data into training and testing sets, allowing you to measure how well your model performs on unseen data. Back testing takes this further by simulating how your model would have performed during specific historical periods.

Building your first predictive timeline model

You don't need to be a data scientist to start making useful predictions. Think of this like learning to drive: you start with the basics and get better with practice. Here's how to build something that actually works:

1. Pick one specific thing to predict

Don't start with "improve business performance." That's like saying "drive somewhere nice." Instead, choose something concrete like "how many customers will cancel next month" or "which product will we run out of first." The more specific you get, the better your results will be.

2. Gather your historical data (and don't panic about perfection)

You need at least 18-24 months of data, but start with whatever you have. Monthly sales figures, weekly website visits, daily support tickets; anything with dates attached. Don't worry if some data is missing or messy. You can clean it up as you go, and imperfect data often beats no data.

3. Make a simple chart and look for obvious patterns

Put your data in a spreadsheet and create a basic line chart. You're looking for things like "sales always spike in December" or "our website crashes every Monday morning." These obvious patterns are often the most valuable ones. If your teenager can spot a trend, that's a good sign.

4. Start stupidly simple

Your first model should be embarrassingly basic. If sales went up 5% last month, predict they'll go up 5% next month. If customer cancellations happen every 90 days on average, mark your calendar. These simple approaches often work better than complex ones, especially when you're starting out.

5. Test your predictions before trusting them

Take your last year of data and pretend it's "the future." Run your model on everything before that year and see how well it would have predicted what actually happened. If it's wrong more than 70% of the time, go back to step 4 and try something simpler.

6. Start small and watch what happens

Don't bet the company on your first model. Use it to make small decisions first. Ordering 10% more inventory, scheduling one extra support person, or planning a modest marketing campaign. Track how well your predictions match reality and adjust from there.

Once you've got a simple model working reliably, you might wonder about those fancy AI techniques you keep hearing about. While basic approaches handle most business needs, some situations do benefit from more sophisticated methods.

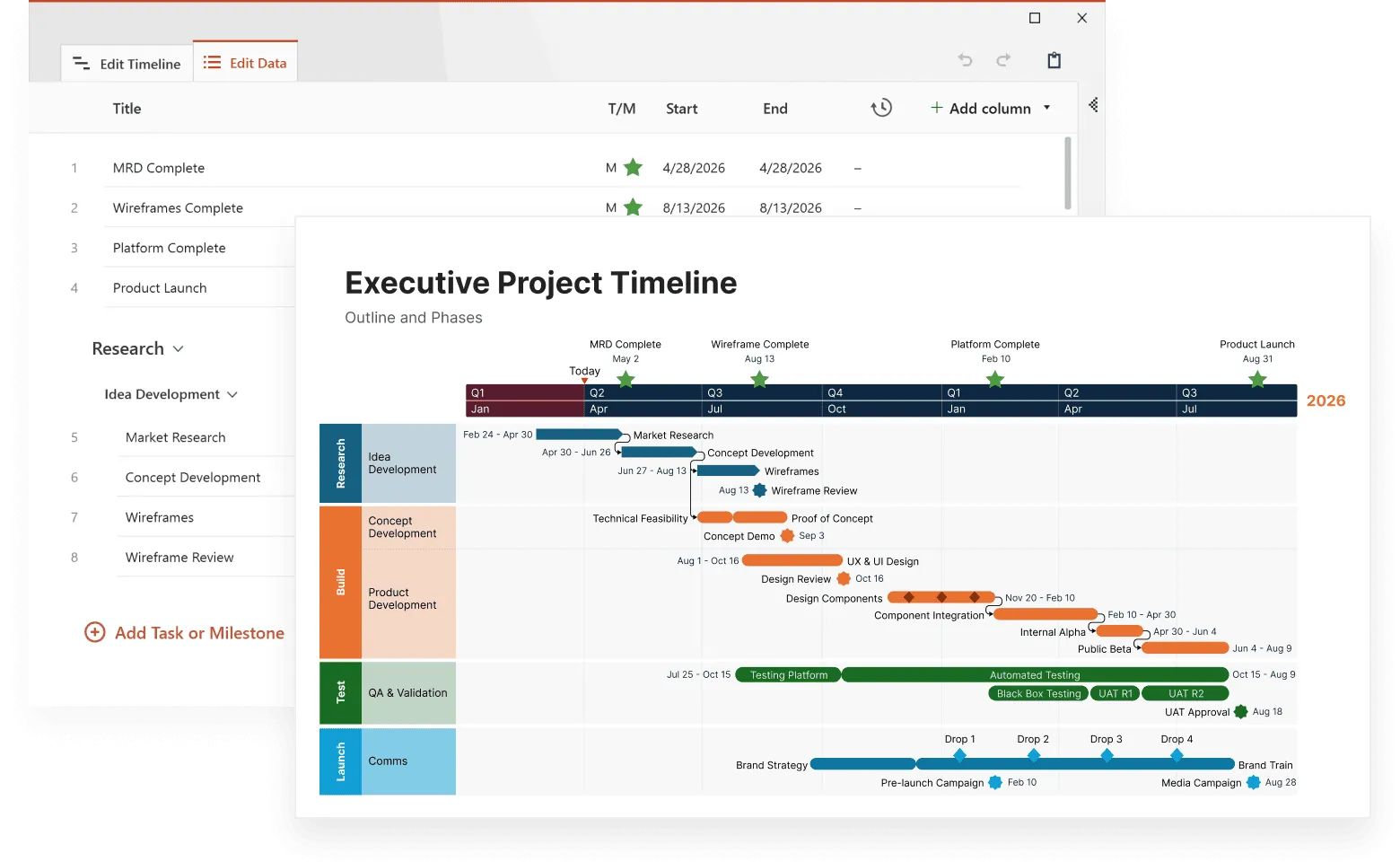

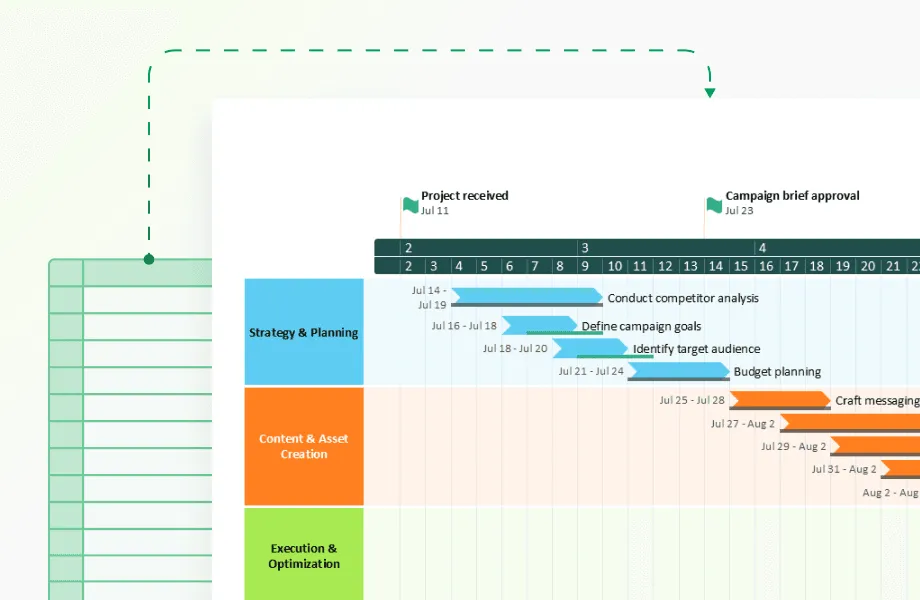

Make prediction timelines simple

Try Office Timeline for free. Create polished timeline charts in PowerPoint that make your trend lines, cycles, and forecast ranges easy to understand.

Advanced techniques and modern approaches

After you've mastered the basics and seen real results, you might want to explore what the pros use. These advanced methods can squeeze more accuracy out of your data, but they come with their own costs and complications.

When artificial intelligence actually helps

Machine learning algorithms can spot patterns your eyes miss, like how customer behavior changes 73 days before they cancel, or how weather in one region affects sales in another three weeks later. Neural networks work like extremely powerful pattern-matching machines that can juggle hundreds of variables at once.

LSTM networks (think of them as AI with really good memory) excel when past events matter for long periods. They can remember that every time your biggest client places an order in January, they go quiet for exactly four months, then come back with an even bigger purchase. Traditional methods struggle with these long-term connections.

Real-time predictions that update themselves

Some businesses need predictions that change as fast as their data does. Stock traders, website administrators, and supply chain managers can't wait for weekly reports, they need forecasts that update every minute or hour as new information flows in.

The reality check on fancy methods

Here's what the sales pitches don't tell you: advanced techniques need massive amounts of clean data, expensive computing power, and people who really know what they're doing. A poorly implemented AI model often performs worse than a simple spreadsheet formula.

More importantly, complex models become black boxes. When your AI predicts that sales will drop 30% next month, you can't easily figure out why or whether to trust it. Simple models might be less accurate, but at least you understand their reasoning.

The hybrid approach that actually works

Most successful companies mix simple and complex methods. They use basic models for daily decisions and sanity checks, then layer on sophisticated algorithms for the tricky problems. This gives you the best of both worlds: reliable baselines you can trust plus advanced insights when you need them.

Even the best prediction system will run into problems that could derail your entire project. Knowing what these issues look like and how to handle them can save you months of frustration.

Common challenges and practical solutions

Even when you do everything right, prediction projects hit predictable roadblocks. Here are the ones that trip up most people, and what you can do about them.

- Your data is messier than you think

Real-world data always has problems. Sales records missing from that week when the system crashed. Different people measuring things different ways. Numbers that look right but are actually wrong because someone entered "1000" instead of "100."

Solution: Start by assuming your data has issues and go hunting for them. Look for obvious outliers, gaps in time series, and sudden jumps that don't make business sense. Build simple checks, like flagging any sales figure that's 10x higher than normal, and investigate before including questionable data in your model. - Your model becomes too clever for its own good

Sometimes prediction models get so good at memorizing your historical data that they can't handle anything new. It's like a student who memorizes test answers instead of learning the subject. They ace practice tests but fail when facing new questions.

Solution: Always test your model on data it hasn't seen before. If it performs amazingly on your training data but terribly on new data, it's probably memorizing rather than learning. Simplify your approach or get more data to train with. - The world changes and your model doesn't notice

Your customers start behaving differently. A new competitor enters the market. A pandemic changes everything overnight. Your model keeps predicting based on how things used to work, not how they work now.

Solution: Watch your prediction accuracy like a hawk. When it starts getting worse, dig into what's changed in your business or industry. You might need to retrain your model with recent data or adjust for new factors that weren't important before. - Too many moving parts

The economy affects your sales. Weather affects your website traffic. Your competitor's new product affects your customer retention. You could include all these factors, but now your simple prediction model needs economic data, weather feeds, and competitive intelligence just to work.

Solution: Start with the factors you can easily measure and control. Add outside influences one at a time, and only if they clearly improve your predictions. More complexity isn't always better. - Nobody understands what your model is telling them

You build a sophisticated prediction system that's 85% accurate, but when it tells your boss that sales will drop 20% next month, they ask "why?" and you can't explain it. Technical accuracy doesn't matter if people don't trust or understand your predictions.

Solution: Always start with simple, explainable models that people can understand. Even if you use complex methods later, keep a simple backup model that can help explain the reasoning. When presenting predictions, focus on what actions people should take, not how clever your algorithm is.

These challenges might seem overwhelming, but don't let them stop you from getting started. Every successful prediction project began with someone taking the first step, despite not having perfect data or unlimited resources. The key is starting small and learning as you go.

Practical applications

Seeing timeline prediction in action across different sectors reveals patterns you can adapt to your own situation, regardless of your industry.

Manufacturing

Manufacturers use timeline analysis to shift from reactive fixes to planned maintenance. Instead of waiting for machines to break down, manufacturers now track vibration patterns, temperature changes, and performance metrics over time. When a motor's vibration increases gradually over three months, that signals bearing wear. Allowing repairs during scheduled downtime rather than costly emergency shutdowns. The result: 30-50% less downtime and significantly lower maintenance costs.

What you can apply: Watch for slow changes in your numbers that happen before big problems. Customer complaints building up, people quitting more often, or your website getting slower often show warning signs weeks before they become major issues.

Finance

Financial institutions use timeline analysis to spot trouble before it hits. Banks don't just look at individual transactions, they analyze spending sequences over time. If someone who typically makes small, local purchases suddenly starts large online transactions in different countries, the timeline pattern triggers fraud alerts. Credit decisions factor in years of payment timing, employment stability, and account activity patterns.

What you can apply: Track when your customers, employees, or systems start acting differently than usual. Big changes from normal patterns are worth checking out. They might signal new opportunities or problems coming your way.

Healthcare

Hospitals use timeline analysis to get treatment timing right for each patient. Hospitals track how patients respond to treatments over time, identifying which intervention sequences work best for different conditions. They can predict which patients need closer monitoring and when recovery milestones should occur, optimizing both outcomes and resource allocation.

What you can apply: If you work with customers over time, learn their typical patterns. When you know how things usually progress, you can spot when someone needs help or is ready for the next step.

E-commerce

E-commerce companies use timeline analysis to balance inventory. They avoid running out of popular items and also costly overstock. Online retailers combine purchase histories, seasonal patterns, marketing campaign effects, and external factors like weather or economic news to predict demand. This prevents both stockouts that lose sales and excess inventory that ties up cash.

What you can apply: Don't just look at one thing when making predictions. Weather, news, competitor moves, and other outside factors often affect your results more than you think.

These real-world examples show the potential, but you might be wondering how to actually build something like this for your own business. The good news is that you don't need a data science PhD or expensive software to get started. Here's how to create your first working model.

Getting started: your next steps with timeline-based predictions

Predicting the future is not magic. It is based on pattern recognition with better math. While you can't forecast everything, you can get surprisingly good at predicting the things that matter most to your business.

The tools and techniques exist, the data is probably already there, and the potential benefits are real. The only question could be how to take the first step. Start with one small prediction project and you might be surprised by what patterns you discover hiding in your own data.

- Choose your first project. Look for something that meets three criteria: you have decent historical data, you can measure success clearly, and someone with decision-making power actually cares about the outcome. Predicting monthly customer churn works better than trying to forecast "business performance" because it's specific, measurable, and actionable.

- Start simple. Don't jump straight to machine learning. Some of the most valuable predictions come from basic math that anyone can understand. If your average customer stays for 14 months, predict that new customers will do the same. If sales always spike 20% in November, plan for it. Master these simple approaches before getting fancy.

- Get the right people involved early. You need three types of people on your team: someone who understands the business problem deeply, someone who can work with data and build models, and someone who can actually act on the predictions you make. Missing any of these three usually means your project will build something impressive that nobody uses.

- Fix your data collection now, thank yourself later. The biggest mistake most people make is jumping into modeling with messy data. Spend time up front making sure you're collecting consistent, accurate information. Set up simple processes to catch errors early. Your future self will thank you when you're not spending months cleaning up data that should have been right from the start.

- Track everything and learn fast. Keep records of what you predicted, what actually happened, and what you learned. This is as much about measuring accuracy as it is about understanding when your methods work well and when they don't. These insights become the foundation for your next, better prediction project.

The companies that succeed with timeline prediction share a common approach: they start simple, focus on problems they can actually solve, and build their capabilities gradually. They don't try to predict everything at once or build the perfect model on their first attempt. Most importantly, they remember that predictions are only valuable if they lead to better decisions. A rough forecast that helps you stock the right amount of inventory beats a precise model that nobody understands or trusts.

Frequently asked questions

These are the questions we hear most often from people starting their first prediction projects. The answers might save you weeks of trial and error.

18-24 months for most business applications, but you can often start with less.

The "official" recommendation is 24-36 data points to spot basic patterns, but don't let this stop you from starting. Monthly data needs about 18-24 months for solid business predictions, while weekly data often reveals useful patterns in just 6-12 months. Daily data can work for operational forecasting with only 3-6 months of history. If you're in a seasonal business, you'll need at least 2 full cycles, which usually means 2-3 years for annual patterns.

Quality beats quantity every time. Six months of clean, consistent data often produces better results than three years of messy records where definitions changed or people measured things differently.

70-85% for most business applications, but even 60% accuracy can be incredibly valuable.

Your accuracy depends on what you're predicting and how far ahead. Short-term forecasts for the next month typically hit 80-95% accuracy for stable business metrics. Medium-term predictions for next quarter usually fall between 65-80% for most applications. Long-term forecasts for next year drop to 55-70%, but they're still useful for planning. In volatile markets, you might only get 55-65% directional accuracy, but knowing whether things will go up or down is still valuable.

Remember, you're not competing with perfection, you're competing with guessing. If your current planning assumes "things will stay the same," even 65% accuracy represents a huge improvement.

Rare events, human psychology, and systems with too many moving parts resist prediction.

Timeline analysis works best when patterns repeat and underlying systems stay consistent. It struggles with:

- Black swan events - Market crashes, pandemics, viral trends

- Human behavior changes - New social media platforms, shifting consumer preferences

- Complex interactions - When small changes create big, unpredictable effects

- First-time events - New product launches, entering new markets

Stick to predicting things that have happened before in similar circumstances. Your model can't forecast what it's never seen.

Yes, but fix what you can and be honest about the limitations.

Missing data doesn't kill prediction projects, but it does make them harder. Modern techniques can handle random missing points by filling gaps using surrounding data, irregular timing like weekly data with some missing weeks, and changing definitions when you started measuring things differently.

However, certain problems are harder to fix. Systematic gaps where data goes missing every December because systems shut down, quality changes when accuracy improved dramatically at some point, and definition changes when "customer" meant different things over time all create bigger challenges.

Start by cleaning what you can, then build simple models to see what's possible. You might be surprised how much insight you can extract from imperfect data.

Start with simple tools you already have, then upgrade based on what you learn.

Most people overthink this decision. Start with Excel or Google Sheets using basic trendlines and moving averages. Seriously. Many valuable predictions come from simple math that spreadsheets handle perfectly. If spreadsheets become limiting, try tools like Tableau or Power BI, or even Python if someone on your team knows it. Only consider specialized forecasting software or custom solutions after you've proven value with simpler approaches and have specific requirements they can't meet.

The best prediction system is the one people actually use to make better decisions. Sophisticated models that sit unused are worthless compared to simple forecasts that change how your team operates.