Every second, millions of data points flow through businesses worldwide. Stock prices fluctuate. Website traffic ebbs and flows. Sales numbers climb and dip. All part of measurable patterns that unfold over time.

Time series analysis transforms these scattered data points into actionable insights. When you understand how to read temporal patterns, you gain the power to anticipate what comes next. Visual tools like timelines make these patterns easier to grasp and communicate.

This article walks you through the practical methods and real-world applications that turn temporal data into predictive intelligence, showing how timelines in data science help convert temporal information into clear, accurate forecasts.

What makes time series analysis different from regular data analysis

Regular data analysis examines individual snapshots of information. Time series analysis studies how those snapshots connect and change over time. Just like watching a movie instead of looking at a single photograph.

Time series data consists of observations recorded at specific time intervals, e.g. hourly temperature readings, daily stock prices, monthly sales figures. The sequence matters because each data point connects to what came before and influences what follows.

Consider your company's website traffic. A standard analysis might show you averaged 1,000 visitors last month. Time series and analysis reveals the deeper story: traffic peaks every Tuesday at 2 PM, drops during lunch hours, and surges before major product launches.

This temporal dimension changes everything. Time sequence analysis describes what happened, but also explains why patterns emerge and when they're likely to repeat.

The four components of your data

Every time series contains four distinct elements, though they're not always obvious at first glance.

- Trend: represents the long-term direction. Is your metric generally increasing, decreasing, or staying flat over months or years? E-commerce sales might show an upward trend as your business grows.

- Seasonality: captures predictable, recurring patterns. Retail sales spike during holidays. Air conditioning repairs increase in summer. These cycles repeat at regular intervals.

- Cyclical patterns: resemble seasonality but lack fixed timing. Economic recessions create cyclical patterns in employment data, but they don't occur every three years like clockwork.

- Irregular variations: include everything else, like random fluctuations, one-time events, and noise that doesn't fit the other categories.

Understanding these components separately allows you to build more accurate forecasts and spot anomalies when they occur.

How to start analyzing time series data

Start your analysis with a clear plan. While every dataset is different, following these steps will guide you through the process.

- Plot your data first

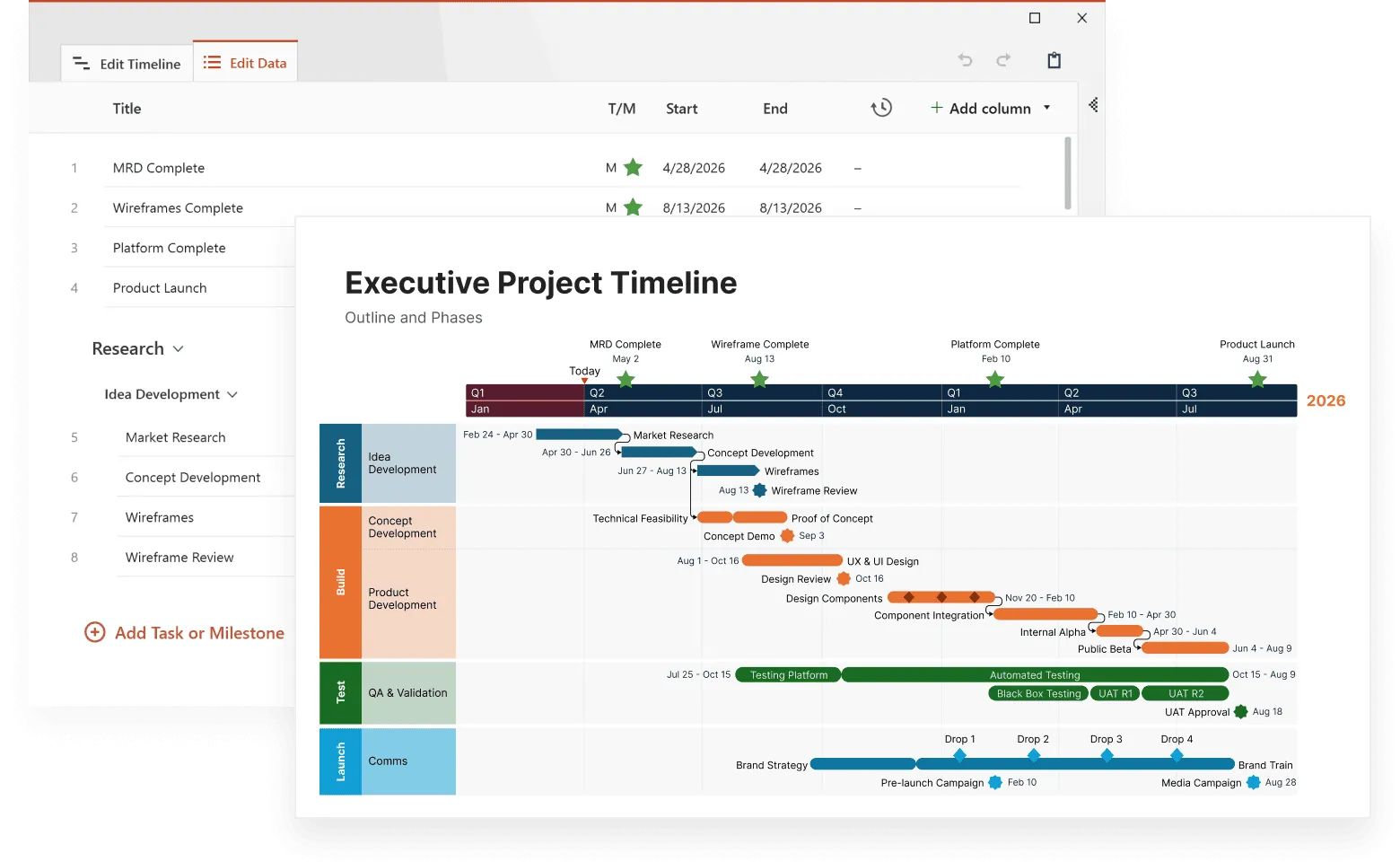

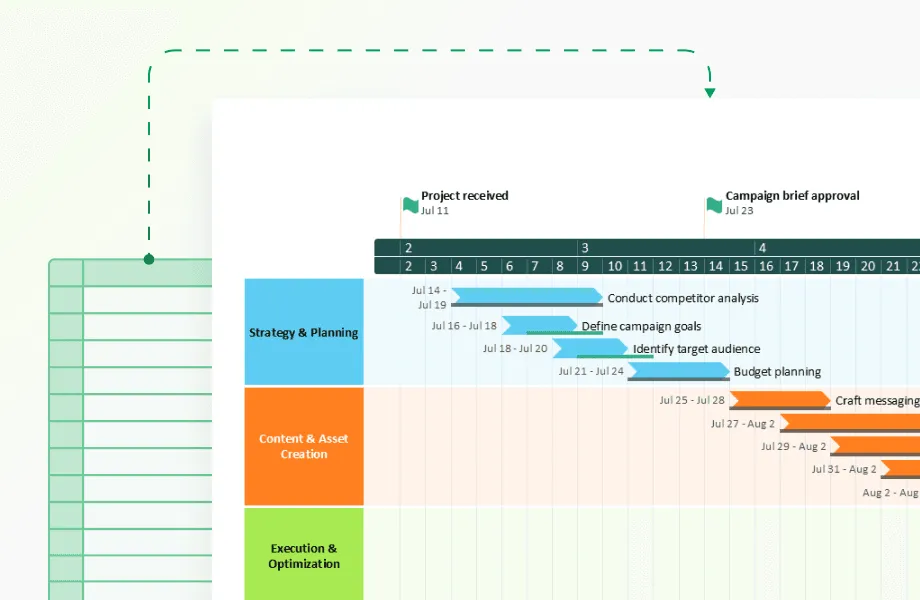

Create a basic timeline visualization using tools like Office Timeline or similar timeline makers. This reveals obvious patterns, outliers, and data quality issues that statistical tests might miss. - Check for stationarity

Stationary data has consistent statistical properties over time. Most forecasting methods assume stationarity, so you'll need to transform non-stationary data. - Identify missing values

Time series analysis requires complete sequences. Decide whether to interpolate missing values, remove affected periods, or use methods that handle gaps. - Remove or account for outliers

Extreme values can distort your analysis. Determine whether outliers represent genuine events worth preserving or measurement errors to correct. - Decompose the series

Separate trend, seasonal, and irregular components. This step reveals which elements drive your data's behavior.

The order matters here: plotting data before applying statistical tests prevents you from missing obvious issues that could invalidate your results.

Popular methods for time series forecasting

Short-term forecasts often succeed with simple methods like moving averages, while long-term predictions may need complex models that capture seasonal cycles and external factors.

- Moving averages smooth short-term fluctuations by averaging recent observations. Simple to calculate and interpret, they work well for data without strong trends or seasonal patterns.

- Exponential smoothing gives more weight to recent observations while still considering historical data. This method adapts quickly to changes while maintaining stability.

- ARIMA models (Autoregressive Integrated Moving Average) handle complex patterns by combining autoregression, differencing, and moving averages. They're powerful but require careful parameter selection.

- Machine learning approaches including neural networks can capture non-linear relationships and interactions between multiple variables. They excel with large datasets but need substantial training data.

- Regression-based methods work well when you can identify external factors that influence your time series. They explicitly model relationships between predictors and outcomes.

Choose your method based on data characteristics, required accuracy, and available computational resources. Simple methods often perform surprisingly well, especially for short-term forecasts.

Spotting anomalies and unusual patterns

Anomaly detection in time series requires understanding normal behavior first. What looks unusual depends entirely on context and expected patterns.

- Statistical approaches compare new observations to historical distributions. If today's value falls outside typical ranges, it triggers an alert. This works well for detecting sudden spikes or drops.

- Machine learning methods learn complex normal patterns and flag deviations. They can identify subtle anomalies that statistical tests miss, but they require more data and computational power.

- Domain knowledge often beats purely statistical approaches. A 50% increase in website traffic might be anomalous statistically but perfectly normal if you just launched a marketing campaign.

Combining multiple detection methods reduces false positives while catching genuine anomalies. Set up your system to flag potential issues for human review rather than automatically assuming every statistical outlier represents a problem.

Applications that highlight the power of time series analysis

Understanding time series becomes clearer through concrete examples across different industries. See how companies across industries turn temporal patterns into competitive advantages.

- Financial markets rely heavily on time series forecasting. Traders analyze price movements, volume patterns, and volatility to make investment decisions. Algorithmic trading systems process thousands of time series simultaneously, identifying opportunities faster than human traders.

- Supply chain management uses demand forecasting to optimize inventory levels. Retailers analyze sales history to predict future demand, accounting for seasonal trends, promotional effects, and economic conditions. Better forecasts reduce both stockouts and excess inventory.

- Web analytics reveals user behavior patterns over time. Traffic analysis identifies peak usage periods, seasonal variations, and the impact of marketing campaigns. Timeline visualization tools like Office Timeline can help present these insights clearly to stakeholders. This information guides capacity planning and content strategy decisions.

- Industrial maintenance applies time series analysis to sensor data from machinery. Vibration patterns, temperature readings, and other metrics help predict when equipment needs service before failures occur.

- Healthcare monitoring tracks patient vital signs over time. Continuous glucose monitors help diabetic patients understand how their blood sugar responds to food, exercise, and medication throughout the day.

Each application demonstrates how analyzing time series data reveals actionable insights that static analysis would miss.

Tools and software for time series analysis

Your choice of tools depends on technical expertise, budget, and specific requirements. The right tool can make the difference between spending hours wrestling with complex code or getting insights in minutes with a few clicks.

- Spreadsheet software handles basic time series tasks. Excel and Google Sheets can create simple forecasts and visualizations, though they lack advanced statistical capabilities.

- Statistical software like R and Python offer comprehensive time series libraries. R's forecast package and Python's statsmodels provide professional-grade analysis tools. These require programming knowledge but offer maximum flexibility.

- Specialized platforms like Tableau and Power BI provide data visualization capabilities (including time series charts, user-friendly interfaces for time series visualization and basic analysis), and balance ease of use with analytical capability, while timeline tools such as Office Timeline and other timeline makers focus on creating chronological visuals like Gantt charts and project timelines.

- Database solutions designed for time series data, including InfluxDB and TimescaleDB, handle large-scale data storage and querying efficiently.

- Cloud services from major providers offer managed time series analysis capabilities. These solutions scale automatically and integrate with other business systems.

Start with simpler tools and upgrade as your needs become more sophisticated. Many successful analyses use basic methods implemented in accessible software.

Turn patterns into clear visuals

Try Office Timeline for free. Create polished, presentation-ready timeline slides that make trends and key events easy to understand.

Common mistakes that can derail your analysis

Time series data has unique quirks that catch even seasoned analysts off guard. They are systematic traps that emerge from the temporal nature of the data itself.

- Ignoring data quality leads to unreliable results. Missing values, measurement errors, and inconsistent collection intervals corrupt your analysis. Always examine your data carefully before applying statistical methods.

- Overfitting models creates forecasts that work perfectly on historical data but fail miserably on new observations. Complex models aren't always better; simple approaches often forecast more accurately.

- Forgetting domain knowledge produces technically correct but practically useless results. Statistical significance doesn't guarantee business relevance. Include subject matter experts in your analysis process.

- Mixing different data sources without proper alignment creates artificial patterns. Make sure all your time series use consistent time zones, measurement units, and collection frequencies.

- Assuming stationarity when it doesn't exist leads to invalid statistical inferences. Many real-world time series have trends, changing variances, or evolving seasonal patterns that violate stationarity assumptions.

- Extrapolating too far beyond your training data reduces forecast accuracy. The further you predict into the future, the less reliable your forecasts become.

Avoiding these mistakes requires careful attention to both statistical theory and practical considerations.

Building your time series analysis skills

Developing expertise in analyzing time series data takes practice with real datasets and problems.

Start with your own data: website analytics, sales figures, or any measurements collected over time. Tools like Office Timeline can help you visualize these patterns before diving into statistical analysis. Personal relevance makes learning more engaging and helps you understand how theoretical concepts apply to practical problems.

Practice with public datasets from government agencies, research institutions, and data repositories. Economic indicators, weather data, and demographic statistics provide rich learning opportunities.

Take online courses focused specifically on time series methods rather than general statistics courses. The temporal aspect requires specialized techniques that general data science education often glosses over.

Join communities where practitioners share experiences and solutions. Time series analysis has enough unique challenges that connecting with others in the field accelerates your learning.

Read case studies from your industry to understand how others apply time series techniques to similar problems. Academic papers and industry reports provide insights into both successful applications and common pitfalls.

Most importantly, start simple and gradually tackle more complex problems. Master basic visualization and trend analysis before attempting advanced forecasting models.

Conclusion

Time series analysis transforms how you understand patterns in data collected over time. Rather than treating observations as independent snapshots, this approach reveals the underlying structure that connects past, present, and future.

The techniques range from simple trend analysis to sophisticated machine learning models, but success depends more on asking the right questions than applying complex mathematics.

Whether you're forecasting sales, monitoring system performance, or detecting unusual behavior, the principles remain consistent: understand your data's components, choose appropriate methods, and validate results against domain knowledge.

Start with basic visualization and gradually build your analytical toolkit. The investment in understanding time series methods pays dividends across virtually every field that collects data over time.

Frequently asked questions

These questions address the most common challenges users face when working with time series data. Each answer provides practical guidance to help you avoid common pitfalls and make better analytical decisions.

Time series analysis specifically examines data collected at regular time intervals, focusing on temporal patterns, trends, and relationships between consecutive observations. Regular data analysis treats each observation as independent, while time series analysis recognizes that the sequence and timing of observations matter for understanding patterns and making predictions.

The amount depends on your data's characteristics and forecast horizon:

- For seasonal data: At least 2-3 complete seasonal cycles (24-36 months for monthly data with yearly seasons).

- For non-seasonal data: 30-50 observations often provide a reasonable starting point.

- For complex patterns: More observations help, but data quality matters more than quantity.

Remember that recent data typically provides more predictive value than older observations, especially in rapidly changing environments.

Yes, but it requires special handling. You can interpolate values to create regular intervals, use methods designed for irregular data, or aggregate observations into regular periods.

Several approaches work depending on your situation:

For short gaps (1-2 missing points): Linear interpolation estimates values based on surrounding observations. This works well when missing data occurs randomly.

For longer gaps: Seasonal decomposition methods can estimate missing periods by using patterns from similar time periods in previous cycles.

For systematic missing data: Consider whether the absence itself provides information. Weekend gaps in business data might be meaningful rather than problematic.

The best choice depends on why data is missing and how much is absent. Never assume missing data is random without investigating the underlying cause.

Compare forecast errors to the cost of wrong decisions. Calculate mean absolute percentage error (MAPE) or mean absolute error (MAE) on held-out test data. A 5% MAPE might be excellent for some applications but inadequate for others. Also consider whether your forecasts consistently over or under-predict, as systematic bias can be more problematic than random errors.